When you pick up a prescription at the pharmacy, you might not realize that your out-of-pocket cost isn’t just about the drug itself-it’s shaped by a hidden system called a formulary. Most employers offering health insurance use these formularies to decide which medications are covered, and how much you pay for them. The system is built around one clear goal: push employees toward generic drugs because they’re cheaper. And it works. But not always in the way you’d expect.

How Your Employer’s Drug Plan Actually Works

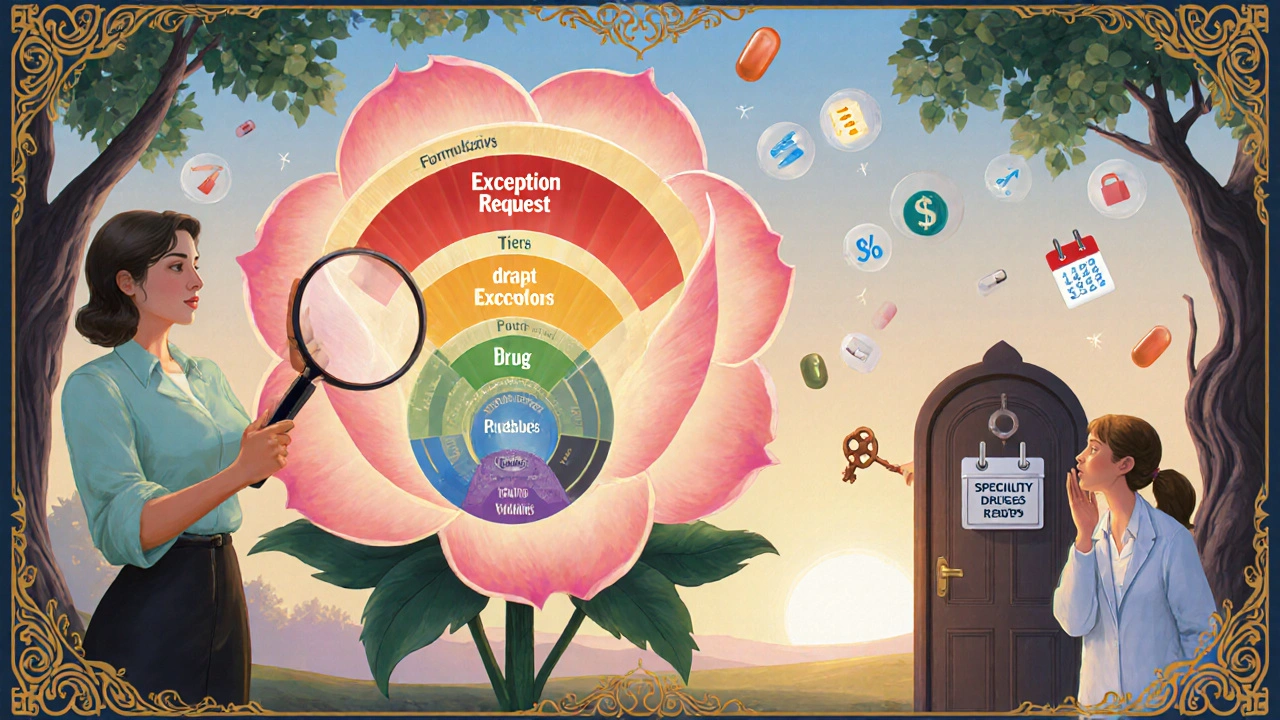

Your employer’s health plan doesn’t just pay for all prescriptions equally. Instead, it groups medications into tiers-like levels in a game-and each tier has a different price tag for you. Tier 1 is almost always generic drugs. That’s where you pay the least: usually $10 or less per prescription. Tier 2 is for brand-name drugs that the plan prefers, often because they’ve negotiated a better deal with the manufacturer. Tier 3 is for brand-name drugs that aren’t preferred-these cost more, maybe $40 to $75. And Tier 4? That’s for specialty drugs-expensive treatments for conditions like cancer, MS, or rheumatoid arthritis. You could be paying hundreds of dollars out of pocket for those. This tiered system isn’t random. It’s designed by Pharmacy Benefit Managers (PBMs)-companies like OptumRx, CVS Caremark, and Express Scripts-that manage drug benefits for most large employers. These PBMs don’t just pick which drugs are covered; they decide which ones get bumped to higher tiers or removed entirely. In January 2024, each of the three biggest PBMs dropped over 600 drugs from their formularies. That means if you were taking one of those medications, your plan no longer covers it-unless you go through a long, confusing exception process.Why Generics Are Pushed So Hard

The reason employers push generics isn’t just about saving money-it’s about saving huge amounts of money. According to the FDA, generic drugs are just as safe and effective as their brand-name versions. The only difference? They don’t spend millions on ads or repeat expensive clinical trials. That’s why generics cost 80-85% less. Schauer Group estimates that generic drugs save the U.S. healthcare system more than $150 billion every year. That’s $3 billion a week. Employers love this. When a brand-name drug loses its patent and a generic hits the market, the PBM automatically moves the brand version to Tier 4 and puts the generic in Tier 1. If you still want the brand-name drug, you pay the full difference. For example, if your insulin used to cost $40 as a preferred brand, but now a generic is available, you might suddenly pay $75 or more just to stick with the name you recognize. It sounds fair. But here’s the catch: the savings don’t always reach you.The Hidden Rebate Game

Pharmaceutical companies don’t just lower prices to compete. They pay rebates-backdoor discounts-to PBMs to get their drugs placed on preferred tiers. These rebates can be massive. KPMG found that, on average, the difference between a drug’s list price and what the PBM actually pays (called the gross-to-net spread) is 55%. That means if a drug’s list price is $100, the PBM might only pay $45 after rebates. But you, the employee, still pay based on the $100 list price. This creates a weird disconnect. The system saves money overall, but you might not see it in your wallet. A PBM might prefer a more expensive brand-name drug over a cheaper generic-not because it’s better, but because the manufacturer pays a bigger rebate. And since you’re paying a percentage of the list price, you end up paying more than you should. Some experts call this a broken system. You’re supposed to benefit from lower costs, but the money saved often goes straight to the PBM or the drug maker-not to you.

What You Can Do to Save Money

You don’t have to be a passive player in this system. Here’s how to take control:- Check your formulary. Visit your insurer’s website and search for your medication. Look for the tier it’s on. If it’s Tier 3 or 4, ask if there’s a generic alternative.

- Ask your doctor. If your prescription is expensive, ask: “Is there a generic version?” or “Is there another drug on Tier 1 that works just as well?” Most doctors are open to switching.

- Use in-network pharmacies. Some plans, like HealthOptions.org’s Price Assure Program, automatically lower your cost when you fill prescriptions at certain pharmacies. Don’t assume your local pharmacy is the cheapest-check your plan’s list.

- Review your Summary of Benefits and Coverage (SBC). This document, which your employer must give you, explains your drug coverage in plain language. Look for sections on “prescription drugs” and “tiered copays.”

- Call your insurer. If your medication was removed from the formulary, ask about a “medical necessity exception.” You’ll need a letter from your doctor, but it’s often approved if there’s no safe generic alternative.

When Generics Aren’t Enough

For people managing chronic conditions-like diabetes, asthma, or high blood pressure-switching to a generic might not be enough. Some specialty drugs have no generic version at all. That’s where programs like HealthOptions.org’s Chronic Illness Support Program (CISP) come in. These programs pair you with a care manager who helps you navigate coverage, find financial assistance, or get prior authorization for expensive drugs. If you’re on a high-deductible health plan (CDHP), you might be paying more out of pocket overall. But even then, choosing generics can make a big difference. One employee in Perth who switched from a brand-name blood pressure med to its generic saved $90 a month-over $1,000 a year.

The Bigger Picture

Employer health plans are under pressure. Drug costs keep rising, and companies need to keep premiums affordable. That’s why formularies are getting tighter. More drugs are being excluded. More rebates are being negotiated. More tiers are being added. But the system isn’t broken because of employers. It’s broken because the middlemen-PBMs-control the rules, and they’re not always transparent. The real challenge isn’t finding generics. It’s understanding why your plan covers what it does, and why you’re being charged what you are. The good news? You’re not powerless. You have access to your plan’s rules. You can ask questions. You can push back. And if you do, you might find that the cheapest option isn’t just the generic-it’s the one you actually understand.What Changes Without Warning

One of the biggest frustrations employees face? Formulary changes happen fast-and without notice. A drug you’ve been taking for years can suddenly be moved to Tier 4, or removed entirely. The Ohio Department of Administrative Services warns that these changes can occur “at any time.” That’s why checking your coverage every few months isn’t optional-it’s essential. Set a reminder every quarter to log into your insurer’s portal. Search for your top three medications. If anything has changed, act fast. Don’t wait until your refill runs out.Final Thought: It’s Not About the Drug-It’s About the System

Generic drugs aren’t just cheaper. They’re proven. Safe. Effective. But the real issue isn’t whether you should use them. It’s whether the system designed to save you money is actually doing it. Most of the time, the answer is yes-for the employer. Sometimes, yes-for the PBM. But for you? It depends on what tier your drug is on, what rebates are being paid behind the scenes, and whether you know how to ask the right questions. Start with one simple step: Look up your next prescription on your plan’s formulary. If you’re paying more than $10 for a generic, you might be missing out.Are generic drugs really as good as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also meet the same strict standards for safety, quality, and effectiveness. The only differences are in inactive ingredients (like fillers or dyes) and packaging. Generics work the same way and have the same risks and benefits.

Why does my insurance cover a brand-name drug but not the generic?

It’s rare, but it can happen. Sometimes the generic hasn’t been approved yet, or the PBM has a deal with the brand-name manufacturer that includes a rebate. Other times, the generic is on the formulary but in a higher tier due to a pricing error. Always check your formulary online or call your insurer to confirm coverage before assuming the generic isn’t covered.

Can my employer change my drug coverage without telling me?

Yes. Employers and their Pharmacy Benefit Managers can update formularies at any time, often without advance notice. Changes are usually posted on the insurer’s website or in your member portal. That’s why it’s important to check your coverage every few months, especially if you take regular prescriptions.

What if my medication was removed from the formulary?

You can request a medical necessity exception. This requires a letter from your doctor explaining why you can’t switch to another drug-either because the generic doesn’t work for you, or because switching would be unsafe. Many exceptions are approved, especially for chronic conditions like epilepsy, heart disease, or autoimmune disorders. Don’t give up-ask your doctor to help you file it.

Do PBMs always pass savings on to employees?

No. PBMs often keep a portion of the rebates they negotiate with drug manufacturers. This is called the gross-to-net spread. Even if the drug’s net cost drops, your copay may stay the same because it’s based on the original list price. This means savings go to the PBM or the drug maker-not always to you.

How do I find out what’s on my plan’s formulary?

Log in to your health insurer’s website and look for a “Drug Formulary” or “Prescription Drug List.” You can also call the customer service number on your insurance card and ask for a copy. Your employer’s HR department may also provide a printed or digital copy of your plan’s formulary during open enrollment.

Are there any programs to help me afford my medications?

Yes. Many employer plans offer programs like Care Management or Price Assure that help you find lower-cost alternatives, apply for patient assistance, or get prior authorization for expensive drugs. Check with your HR department or insurer to see what support is available. Some drug manufacturers also offer copay cards or free medication programs for qualifying patients.

tushar makwana 29.11.2025

i just checked my formulary and my blood pressure med jumped from $5 to $45 overnight. no warning. how is that fair? i dont even know who to complain to.

Mary Kate Powers 29.11.2025

if you're paying more than $10 for a generic, you're probably not using an in-network pharmacy. check your insurer's website-they have a list of cheaper ones. i saved $80/month just by switching from CVS to Walgreens. it's not magic, just paperwork.

Richard Thomas 29.11.2025

The structural inefficiencies inherent in the Pharmacy Benefit Manager (PBM) ecosystem are not merely a function of tiered formularies but are symptomatic of a broader pathological alignment of incentives wherein rebates are prioritized over patient outcomes. The gross-to-net spread, as referenced in the article, represents a systemic distortion of market transparency, wherein the consumer remains oblivious to the actual cost dynamics that govern their pharmaceutical expenditures. This is not a flaw-it is the design.

Sara Shumaker 29.11.2025

it’s wild how we treat medicine like a video game tier system. you get the ‘common’ generic, the ‘rare’ brand-name, and the ‘legendary’ specialty drug that costs your firstborn. but here’s the thing-most of us don’t even know we’re playing. we just show up at the pharmacy and pay. what if we started asking why? not just ‘is there a cheaper one?’ but ‘why is this one so expensive?’ and ‘who’s really getting paid here?’

the real win isn’t switching to generics-it’s demanding transparency. if your copay is based on the list price but the PBM paid 45% less, why are you still paying the full price? that’s not savings. that’s a shell game.

Scott Collard 29.11.2025

you’re all missing the point. if you can’t afford your meds, don’t blame the system. blame yourself for not researching before you got sick.

Robert Bashaw 29.11.2025

my insulin went from $30 to $120 overnight. i cried in the pharmacy aisle. not because i’m weak-but because this system is designed to make you feel guilty for needing help. they call it ‘cost containment.’ i call it financial terrorism.

they took my drug. gave me a generic that made me dizzy. then told me to ‘apply for an exception.’ like i have time to write a novel to a robot customer service bot. i’m working two jobs. i don’t have time to fight for my own life.

linda wood 29.11.2025

so let me get this straight: the system saves billions, but i pay more because some middleman got a kickback? and the doctor’s supposed to fix it? wow. i didn’t know i signed up for a corporate espionage thriller.

Steven Howell 29.11.2025

the practice of formulary management by PBMs is a well-documented phenomenon in U.S. healthcare economics. The lack of regulatory oversight regarding gross-to-net rebates has created a market distortion that incentivizes the placement of higher-list-price drugs over clinically equivalent generics. This is not an anomaly; it is a predictable outcome of a fee-for-service model that decouples cost from value.

Employees who wish to mitigate exposure should engage in proactive formulary auditing, as the article suggests. However, institutional reform is required to align patient cost-sharing with net pricing rather than list pricing. Until then, individual diligence remains the only recourse.

Peter Lubem Ause 29.11.2025

in nigeria, we don’t have formularies like this. if you need a drug, you pay for it-full price, no tiers, no rebates. but here’s what i learned: if you can’t afford it, you don’t take it. that’s why i’m grateful for this system, even with its flaws. at least here, you have options. you have a chance to fight. in my country, you just pray.

so yes, the system is broken. but it’s broken in a way that still lets you win. don’t give up. check your formulary. talk to your pharmacist. ask your doctor. you’re not alone.

Andrew Keh 29.11.2025

the real issue isn’t generics. it’s that we’ve turned healthcare into a contract with invisible terms. you think you’re signing up for care, but you’re actually agreeing to a pricing algorithm you can’t see. if you want to understand your bill, you need to read the fine print. most people don’t. that’s the problem.

jamie sigler 29.11.2025

why am i even reading this? i just take my pills and hope for the best. if i die, at least i didn’t have to think about it.

Mary Kate Powers 29.11.2025

you’re not alone. i had the same thing happen with my asthma inhaler. i called my doctor, they wrote a letter, and within two weeks, my plan approved it. it’s annoying, but it works. don’t let them make you feel like you’re being difficult. you’re just trying to stay alive.