Orphan Drug Exclusivity: What It Means for Patients and Prices

When a drug gets orphan drug exclusivity, a special seven-year market protection granted by the FDA to drugs treating rare diseases affecting fewer than 200,000 people in the U.S. It's not a cure-all, but it’s a powerful tool that shapes who gets treated and how much it costs. This isn’t just a legal footnote—it’s a real factor in whether someone with a rare condition can even get the medicine they need.

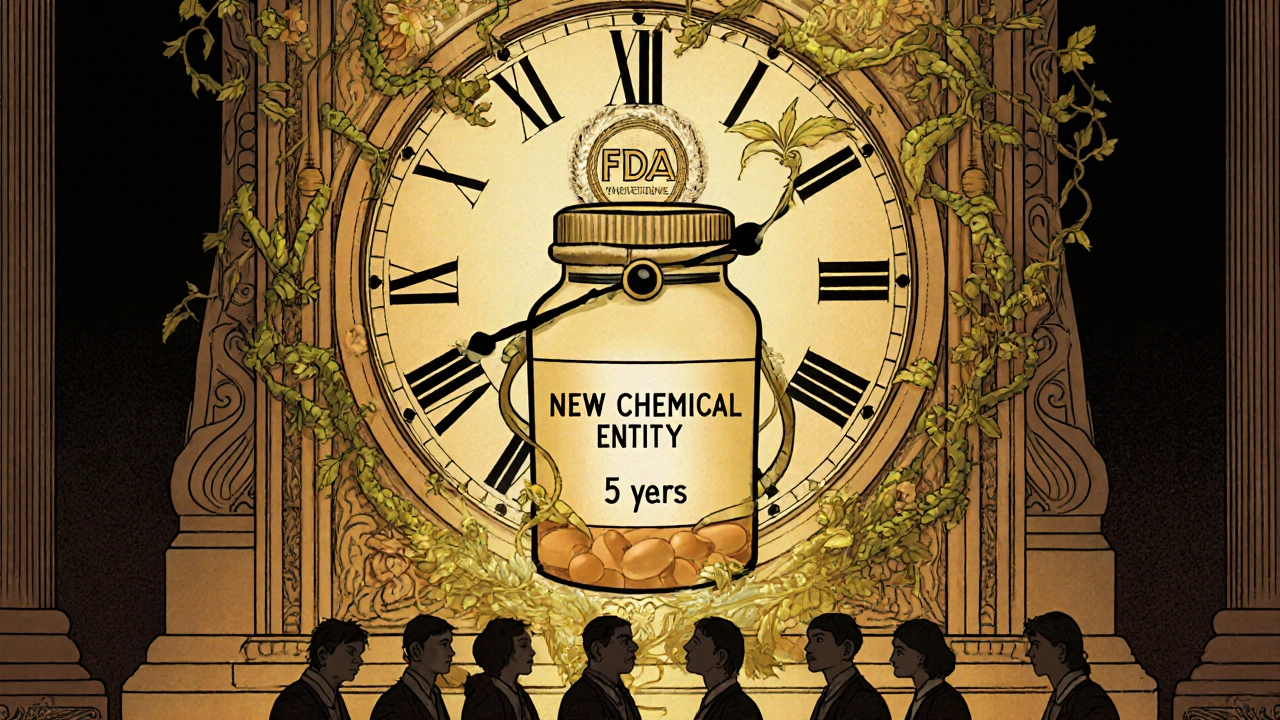

Companies don’t get this protection just for trying. The FDA orphan drug designation, a formal status given before approval to drugs targeting rare diseases, often with clinical evidence of potential benefit. Also known as rare disease drug status, it unlocks tax credits, research grants, and—most importantly—the right to block competitors from selling the same drug for seven years, even after the patent expires. That’s why you might see a drug priced at $500,000 a year: no one else can legally make a cheaper version during that window. It’s not greed—it’s a system designed to reward companies for taking on projects most pharmaceutical firms ignore because they’re too small to profit from.

But here’s the catch: drug pricing, the cost set by manufacturers for medications, often reflects market exclusivity, R&D investment, and lack of competition. Also known as pharmaceutical pricing, it’s the invisible force behind why some life-saving treatments are out of reach for many, even in countries with strong healthcare systems. You’ll see this in posts about how people struggle to afford treatments for conditions like POEMS syndrome or rare forms of epilepsy. The same system that encourages innovation can also create barriers. Some drugs get approved for one rare disease, then get repurposed for another—sometimes stretching the exclusivity rules thin.

And it’s not just about the drug itself. The pharmaceutical incentives, government benefits like tax breaks, fee waivers, and extended exclusivity designed to encourage development of drugs for small patient populations. Also known as rare disease drug incentives, they’re why companies invest in treatments that might only help a few hundred people a year. Without them, drugs for conditions like cystic fibrosis variants or certain inherited neuropathies wouldn’t exist. But when exclusivity lasts too long, or when companies use loopholes to extend it, patients pay the price—literally.

What you’ll find in the posts below aren’t just clinical guides or drug comparisons—they’re real stories about how policy hits the ground. You’ll see how lenalidomide for POEMS syndrome, or indinavir for HIV, fit into this system. You’ll see how generic alternatives get blocked, why some medications stay expensive even after decades, and how patients fight for access. This isn’t abstract regulation. It’s about whether your next prescription is affordable—or even available.