Ever picked up your generic prescription and been shocked by the price? You thought generics were supposed to be cheap-cheaper than brand names, cheaper than other generics. But suddenly, your levothyroxine or metformin costs $45 instead of $5. You’re not imagining it. And you’re not alone. Thousands of people face this every year, confused and frustrated, wondering why their doctor’s prescription is suddenly more expensive-even though the pill looks exactly the same.

What’s Really Going On With Your Generic Copay?

The answer isn’t about quality, effectiveness, or safety. It’s about money. Specifically, the money that Pharmacy Benefit Managers (PBMs) negotiate with drug makers. PBMs like CVS Caremark, Express Scripts, and OptumRx act as middlemen between insurers and drug companies. Their job isn’t to pick the best medicine for you-it’s to get the biggest discount possible. And that’s where tiered copays come in. Most health plans today use a tiered system to split drugs into categories, each with its own price tag. Tier 1 is usually for preferred generics-drugs that the PBM got the deepest discount on. That’s why your $5 atorvastatin lives there. But not all generics make it to Tier 1. Some get pushed to Tier 2, Tier 3, or even higher-even if they’re chemically identical to the cheaper version.Why Would Two Identical Pills Cost Different Amounts?

Here’s the twist: two generic versions of the same drug can have wildly different copays because the manufacturer of one paid the PBM a bigger rebate. Let’s say you take lisinopril. One brand of lisinopril costs $5 because the maker gave the PBM a 70% rebate. Another brand? Same active ingredient, same FDA approval, same pill shape. But the manufacturer didn’t offer a big enough discount. So the PBM puts it in Tier 2-with a $20 copay. This isn’t rare. Around 12-18% of generic drugs in major plans are placed in higher tiers-not because they’re riskier or less effective, but because their makers didn’t cut the best deal. In fact, 68% of generic drugs moved to higher tiers in recent years were bumped due to expired rebate contracts, not clinical reasons. That’s right. Your drug got more expensive because a contract ended.Specialty Generics Are the New Wild West

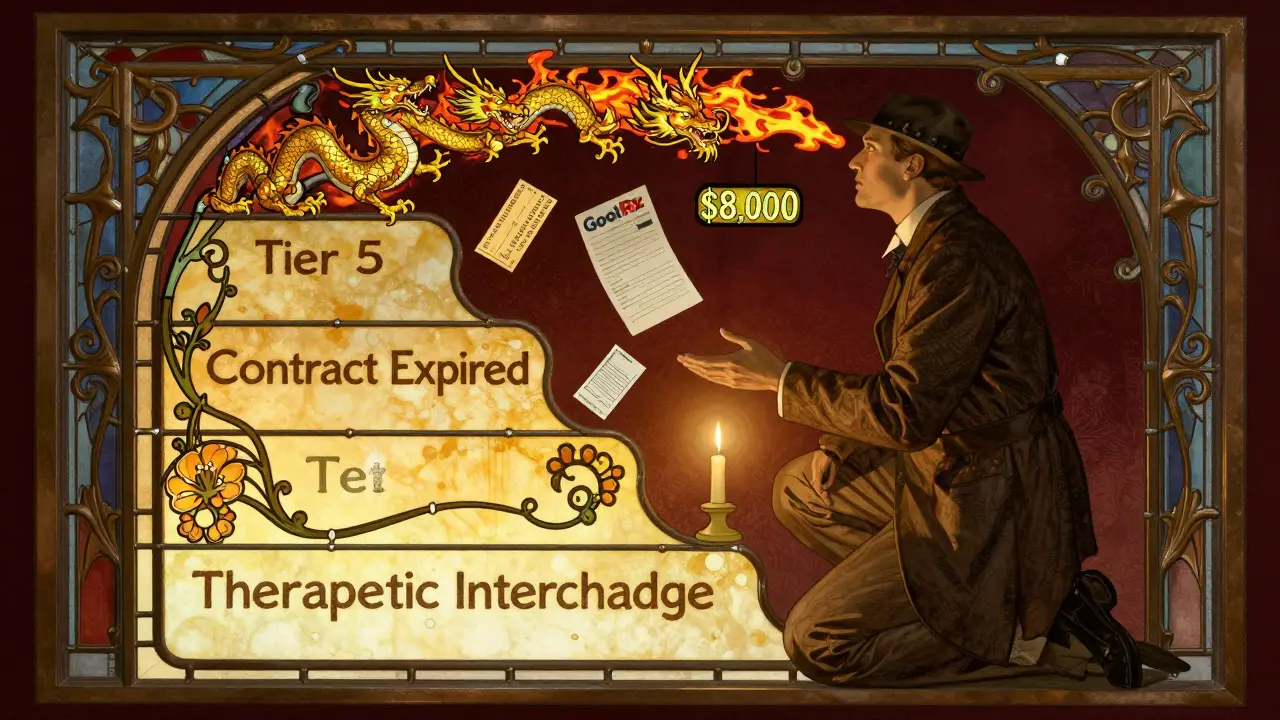

Some generics aren’t just pills. They’re complex biologics-drugs made from living cells, like adalimumab for rheumatoid arthritis. These used to cost over $2,000 a month as brand names. Now, generic versions (called biosimilars) are available. But they’re still expensive to produce. So insurers treat them differently. These aren’t placed in Tier 1 or 2. They land in Tier 4 or 5-specialty tiers. That means instead of a flat $30 copay, you pay 25-40% of the total cost. For a drug that costs $8,000 a month, that’s $2,000-$3,200 out of pocket. Even if you have insurance. Even if it’s a generic. Patients on these drugs often don’t realize they’re in a specialty tier until they get the bill. And there’s little warning. Insurers can change tier placement mid-year, sometimes with just a few weeks’ notice. In 2023, 17% of commercial plans changed their formularies between January and June. That means your $10 generic could become a $100 one overnight.

Why Insurers Don’t Just Use Flat Copays

You might wonder: why not just charge everyone the same amount, no matter the drug? That’s how it used to work. But back in the 1990s, drug prices started skyrocketing. PBMs needed a way to steer patients toward cheaper options without raising premiums. Tiered copays were the solution. Studies show tiered systems cut overall drug spending by 8-12%. They work because people respond to price. If a generic costs $5 instead of $45, most will choose the cheaper one. But here’s the catch: sometimes, the cheaper version isn’t available. Or your doctor prescribed a specific brand because it worked better for you. And now you’re stuck paying more. Worse, some patients stop taking their meds because they can’t afford the higher copay. One study found that when diabetes drugs moved from Tier 2 to Tier 3, adherence dropped by 7.3%. That’s not just inconvenient-it’s dangerous.How to Fight Back When Your Generic Costs Too Much

You can’t change the system overnight. But you can navigate it smarter. First, check your plan’s formulary. Every year, usually in October, insurers update their drug lists. Go to your insurer’s website and search for your medication. Look for the tier. If it’s higher than expected, ask your pharmacist: “Is there another generic version of this drug that’s in Tier 1?” Pharmacists often know which versions are preferred. They can sometimes switch your prescription to a cheaper generic without needing a new doctor’s note. If they can’t, ask your doctor for a therapeutic interchange form. This is a formal request to switch to a lower-tier drug. According to Medicare Rights Center data, 63% of these requests are approved. You can also use tools like GoodRx or SmithRx to compare prices across pharmacies. Sometimes, paying cash at a discount pharmacy is cheaper than using your insurance. And don’t ignore manufacturer assistance programs. In 2023, these programs covered 22% of specialty drug costs for eligible patients.

Stephen Craig 3.01.2026

It’s not about the pill. It’s about who paid whom to make it invisible.

They turned healthcare into a silent auction where your body is the bid.

Vicki Yuan 3.01.2026

I had no idea two identical pills could cost $40 apart. I just assumed generics were generics. This system is so broken it’s almost poetic-like a tax on being sick and not rich enough to navigate it.

Thank you for explaining this so clearly.

Uzoamaka Nwankpa 3.01.2026

I used to work at a pharmacy in Lagos. We had patients who would cry because their insulin cost more than their rent. They didn’t understand why the same medicine had different prices. No one explained it to them. Now I see it’s not just here. It’s everywhere. And no one cares until it’s their turn.

Chris Cantey 3.01.2026

The real conspiracy isn’t that PBMs exist-it’s that we still believe they’re neutral. They’re not middlemen. They’re gatekeepers with spreadsheets and zero moral compass.

They don’t care if you die. They care if the rebate checks clear.

And we keep giving them our trust like it’s a gift, not a hostage situation.

Terri Gladden 3.01.2026

OMG I JUST GOT A BILL FOR $89 FOR MY METFORMIN AND I THOUGHT I WAS GOING TO DIE I’M SO ANGRY WHY DOES THIS HAPPEN TO ME WHY CAN’T THEY JUST MAKE IT CHEAP I HATE THIS SYSTEM I HATE INSURANCE I HATE PHARMACIES I HATE EVERYTHING<3

Jennifer Glass 3.01.2026

I checked my formulary after reading this and found my levothyroxine moved to Tier 3 last month. I didn’t even get a notice.

I called my pharmacy and they had a Tier 1 version I didn’t know about. Switched it. Saved me $32 a month.

Small win. But it’s the only kind we get anymore.

Joseph Snow 3.01.2026

This article is a classic example of liberal misinformation. PBMs are not the problem. The problem is government interference in the free market. If drug companies weren’t forced to compete under price controls, they wouldn’t need rebates. The solution isn’t more transparency-it’s less regulation. And stop blaming corporations for being corporations.

Akshaya Gandra _ Student - EastCaryMS 3.01.2026

i dont get it why do they do this? my mom take diabetes med and she pay 5 doller but now its 30 why? i think its not fair. i am student from india and i think america health care is so crazy

Jacob Milano 3.01.2026

It’s like your doctor writes you a key to a door… but the lock’s been rekeyed by a guy in a suit who never met you.

Same key. Same door. But now you need to pay extra just to turn it.

And the worst part? You’re supposed to be grateful they even let you in.

That’s not healthcare. That’s extortion with a prescription pad.

I’ve seen people skip doses because they’re choosing between insulin and bus fare. That’s not a system failure-it’s a moral collapse.

And yet we keep voting for people who say ‘market forces will fix it’ while their own kids get free insulin.

Maybe we need to stop calling it ‘healthcare’ and start calling it what it is: a lottery where the prize is staying alive.